Why Having a Mileage Tracker App is a Essential Tool for Simple Mileage Logs

Why Having a Mileage Tracker App is a Essential Tool for Simple Mileage Logs

Blog Article

Maximize Your Tax Obligation Deductions With a Simple and Effective Gas Mileage Tracker

In the realm of tax obligation reductions, tracking your mileage can be an often-overlooked yet pivotal job for optimizing your monetary benefits. Recognizing the subtleties of effective mileage monitoring might expose approaches that can considerably affect your tax circumstance.

Significance of Gas Mileage Monitoring

Tracking mileage is crucial for any individual looking for to maximize their tax deductions. Accurate mileage tracking not just makes sure conformity with internal revenue service guidelines yet additionally permits taxpayers to take advantage of deductions connected to business-related traveling. For self-employed individuals and company owner, these deductions can substantially lower gross income, thereby reducing general tax obligation liability.

Additionally, preserving a thorough record of gas mileage assists distinguish in between individual and business-related trips, which is important for substantiating insurance claims during tax audits. The internal revenue service calls for particular documentation, consisting of the date, location, objective, and miles driven for each journey. Without careful records, taxpayers risk losing important reductions or facing penalties.

In addition, reliable gas mileage monitoring can highlight patterns in traveling expenses, helping in better financial planning. By assessing these patterns, people and businesses can recognize possibilities to enhance traveling paths, lower expenses, and improve operational effectiveness.

Selecting the Right Mileage Tracker

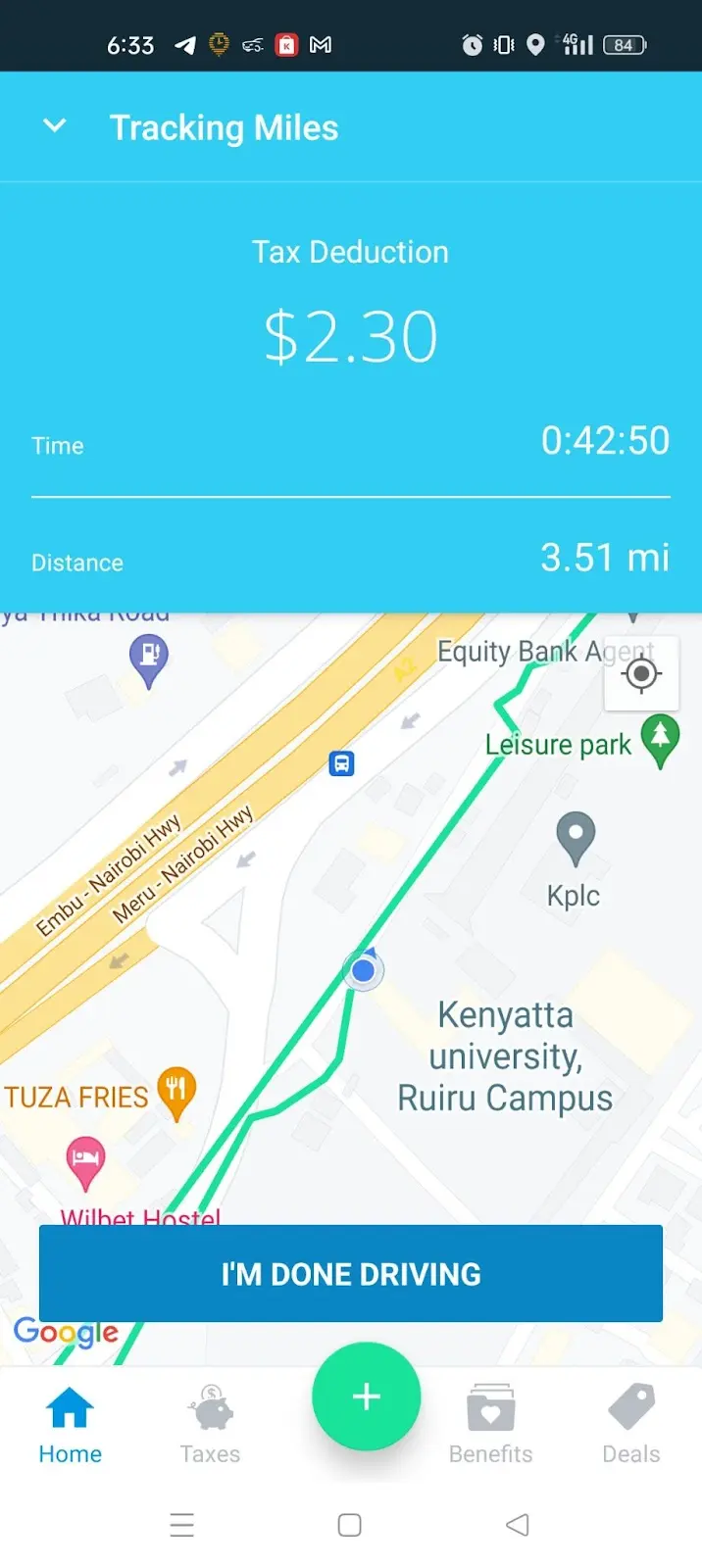

When picking a gas mileage tracker, it is vital to think about numerous attributes and capabilities that align with your details requirements (best mileage tracker app). The very first facet to evaluate is the technique of monitoring-- whether you prefer a mobile application, a GPS gadget, or a hand-operated log. Mobile apps often supply convenience and real-time tracking, while general practitioner devices can provide even more accuracy in distance dimensions

Next, analyze the combination abilities of the tracker. A good gas mileage tracker must flawlessly integrate with audit software application or tax obligation preparation tools, enabling straightforward data transfer and coverage. Seek features such as automated tracking, which reduces the requirement for hand-operated entries, and categorization choices to compare organization and personal trips.

Exactly How to Track Your Gas Mileage

Picking an ideal mileage tracker sets the foundation for effective mileage management. To precisely track your gas mileage, start by establishing the purpose of your travels, whether they are for business, charitable activities, or medical reasons. This clarity will help you classify your journeys and guarantee you record all pertinent information.

Next, constantly log your mileage. For hand-operated entrances, record the beginning and finishing odometer readings, along with the date, purpose, and course of each trip.

It's also important to frequently evaluate your entries for precision and efficiency. Set a timetable, such as once a week or regular monthly, to consolidate your documents. This method helps protect against inconsistencies and ensures you do not overlook any type of deductible gas mileage.

Finally, back up your documents. Whether electronic or paper-based, maintaining back-ups safeguards versus data loss and facilitates very easy gain access to throughout tax preparation. By vigilantly tracking your mileage and keeping organized documents, you will lay the foundation for maximizing your possible tax reductions.

Optimizing Deductions With Accurate Records

Accurate record-keeping is critical for maximizing your tax obligation deductions connected to gas mileage. When you preserve thorough useful reference and accurate documents of your business-related driving, you create a durable structure for claiming reductions that might significantly reduce your taxed income. best mileage tracker app. The internal revenue service requires that you document the day, location, purpose, and miles driven for each trip. Enough detail not only validates your cases yet likewise gives protection in situation of an audit.

Utilizing a mileage tracker article source can enhance this procedure, permitting you to log your journeys easily. Many apps automatically determine distances and categorize trips, saving you time and minimizing mistakes. Furthermore, maintaining sustaining paperwork, such as invoices for associated costs, reinforces your instance for deductions.

It's vital to be regular in recording your gas mileage. Daily monitoring makes certain that no journeys are ignored, which can cause missed out on deductions. On a regular basis examining your logs can assist determine patterns in your driving, enabling better planning and possible tax obligation savings. Inevitably, exact and well organized gas mileage records are essential to optimizing your reductions, ensuring go you make the most of the possible tax obligation benefits available to you as a business vehicle driver.

Typical Blunders to Prevent

Maintaining meticulous documents is a considerable step towards taking full advantage of gas mileage deductions, yet it's just as crucial to be knowledgeable about usual errors that can threaten these initiatives. One prevalent mistake is stopping working to document all journeys precisely. Even small business-related journeys can build up, so overlooking to record them can bring about considerable shed reductions.

Another blunder is not setting apart between individual and company gas mileage. Clear categorization is crucial; blending these two can activate audits and lead to fines. Additionally, some people forget to maintain sustaining files, such as invoices for related expenditures, which can even more confirm claims.

Utilizing a gas mileage tracker application ensures consistent and reputable documents. Acquaint on your own with the most recent regulations regarding mileage deductions to prevent unintentional errors.

Final Thought

In verdict, efficient mileage monitoring is vital for taking full advantage of tax reductions. Using a dependable gas mileage tracker simplifies the procedure of taping business-related trips, making certain precise documentation.

Report this page